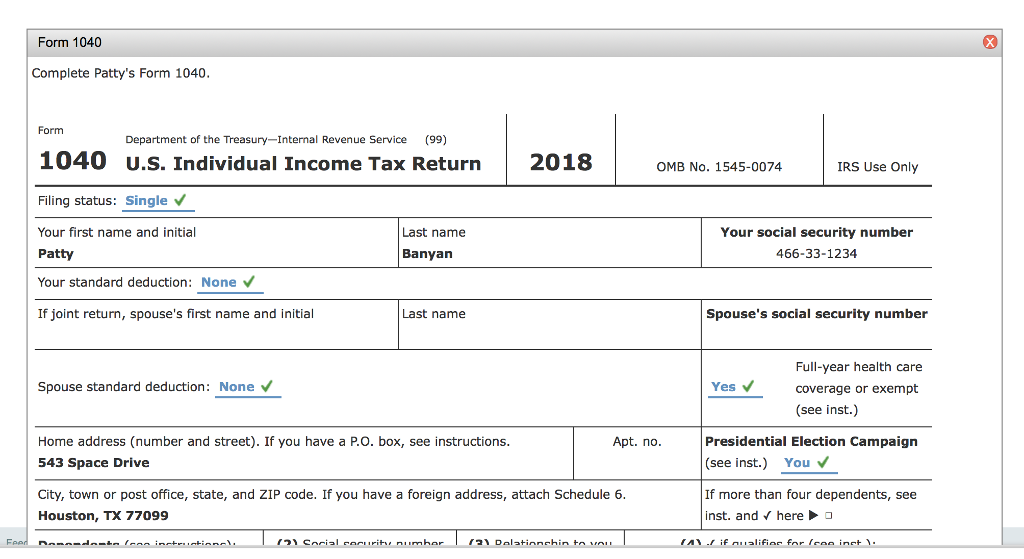

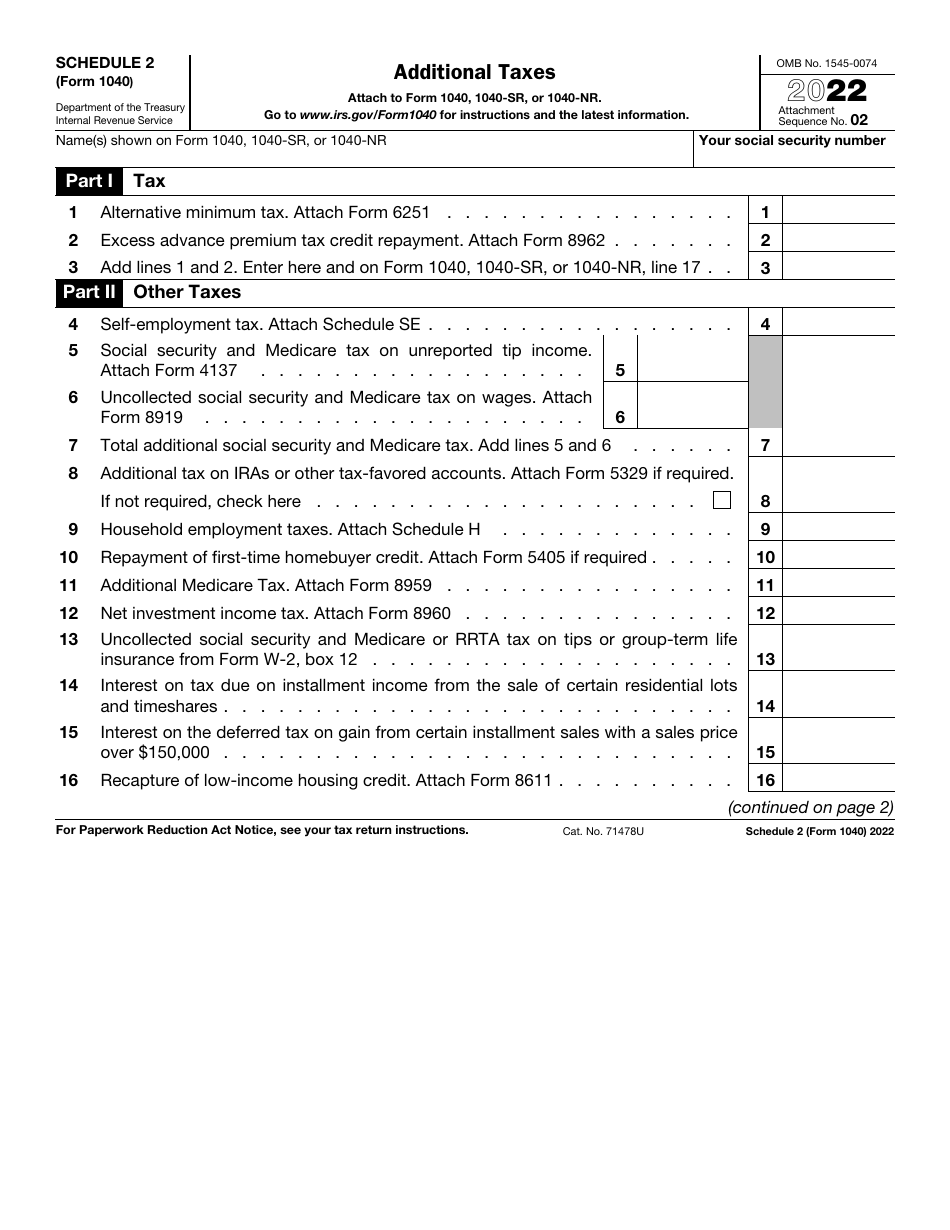

Form 1040 Schedule 2 2025. Sign up now to obtain new tax. Completing irs form 1040 schedule 2 determines your total tax liability.

Request for transcript of tax return form. If you owe additional taxes that aren’t reported on the main.

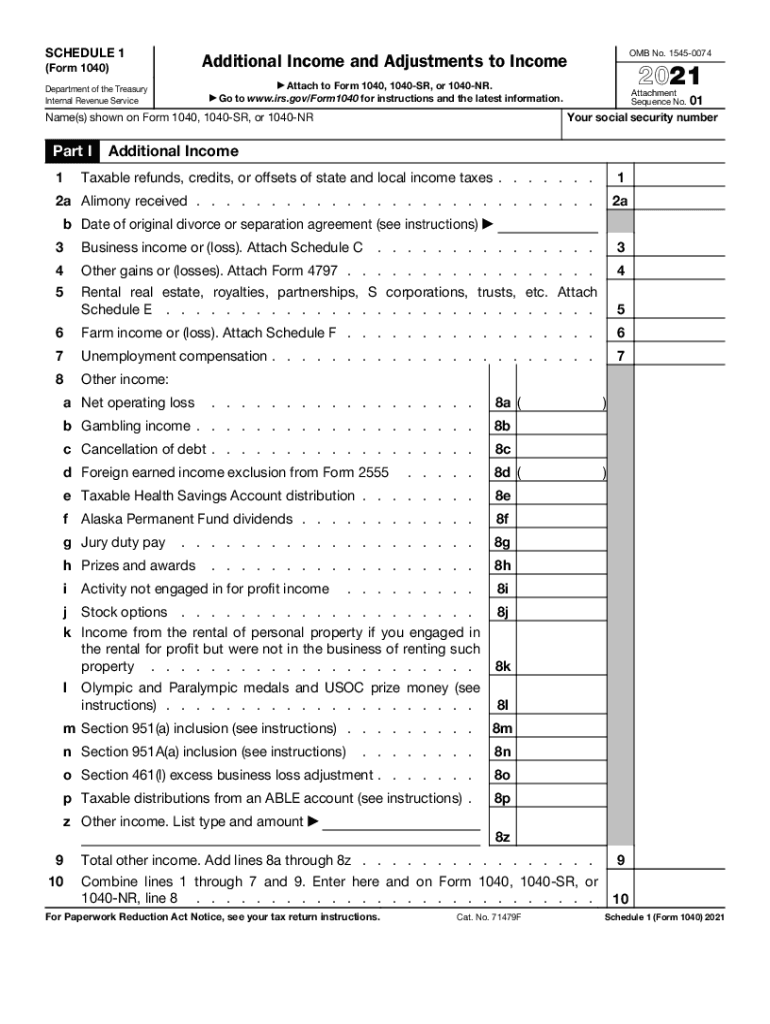

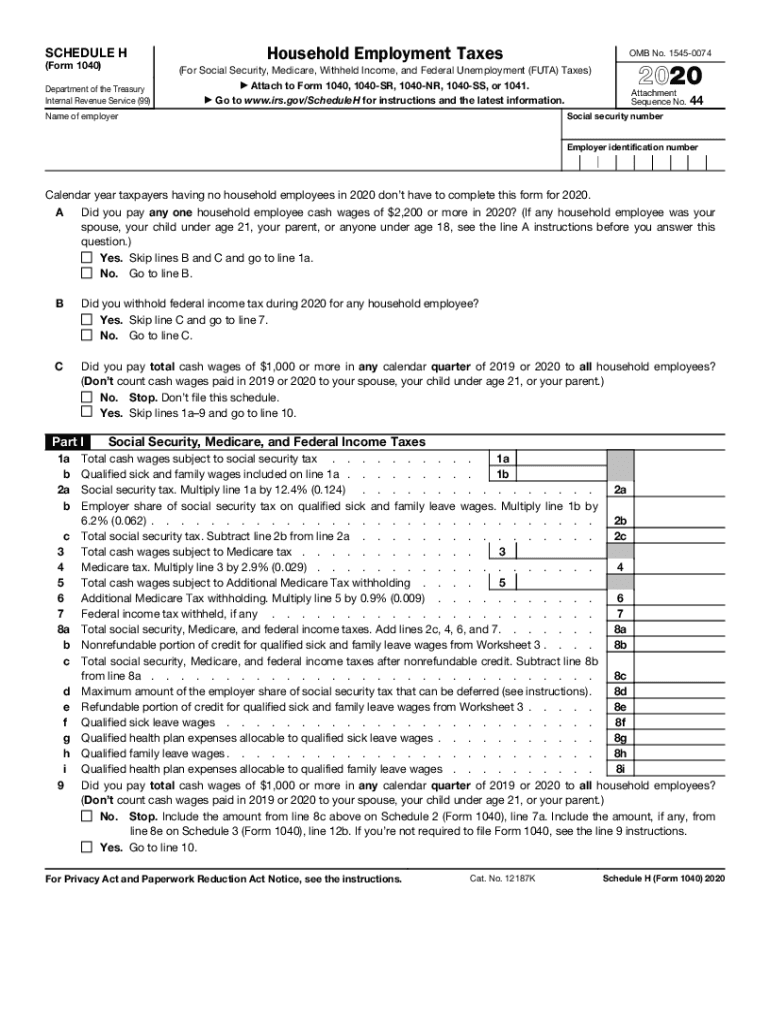

Form 1040, Schedule 2 Additional Taxes. ( AMT, Self Employment Taxes, Form 1040, schedule 1, part ii. If you owe additional taxes that aren't reported on the main.

Form 1040 Schedule 2 A Comprehensive Guide For Taxpayers Eso Events 2023, Completing irs form 1040 schedule 2 determines your total tax liability. Here are some benefits of using schedule 2:.

Form 1040 (PDF) Internal Revenue Service, Taxpayers can review the instructions for schedule a (form 1040), itemized deductions, to calculate their itemized deductions, such as certain medical and dental. Form schedule 2 (form 1040) is a supplementary form used for reporting additional taxes owed or credits claimed by taxpayers.

1040 Schedule 1 20212024 Form Fill Out and Sign Printable PDF, A listing of schedules that are associated with form 1040. This tax return and refund estimator is for tax year 2025 and currently based on 2023/2025 tax year tax tables.

IRS Tax Procedure Code Sections Form 1040 Schedule C Page 2, Individual tax return form that taxpayers use to file their annual income tax returns with the irs. Some common reasons for using schedule 2 include:

2020 Form IRS 1040 Schedule A Fill Online, Printable, Fillable, Blank, Here are some benefits of using schedule 2:. Untaxed portions of ira distributions;.

Form 1040 U.S. Individual Tax Return Definition, Page last reviewed or updated: Untaxed portions of ira distributions;.

IRS Form 1040 Schedule 2 Download Fillable PDF or Fill Online, On this page, we will post the latest tax information relating 2025 as it is provided by the irs. The credit can be worth up to $8,000 and, with some exceptions,.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

1040 Printable Tax Form, This form helps ensure that you are paying the correct amount of tax and helps you avoid. You may need to report this on form 1040, schedule 2.

Irs form 1040 bastawindows, Untaxed portions of ira distributions;. This form helps ensure that you are paying the correct amount of tax and helps you avoid.

We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

Specifically, no itemized deductions included on federal form 1040 schedule a are allowed as north carolina itemized deductions except qualified mortgage interest, real estate.

Equipment Rental WordPress Theme By WP Elemento